Data Center Trends 2026: Industrialization Becomes Reality

The data center sector is ramping up investments starting 2026, with a massive global impact expected: by 2030, around USD 3 trillion could be invested, according to Moody’s and JLL. Europe is keeping pace—just in 2026, the EU may invest over EUR 50 billion, while Romania, entering the scene with the Black Sea AI Gigafactory, could attract around EUR 5 billion through this project.

The rules of the game are changing fast: speed, modularity, and optimization are becoming the new industry standards. Read on to discover the trends that will shape data centers this year.

Data Centers Enter Industrialization: Faster, Modular, Repeatable

Accenture analysts predict that in 2026, the data center sector will enter a new stage: industrialization, where speed and predictability of delivery are decisive. Ambitious timelines are now the standard, and those who build quickly gain market share, although this pace accelerates costs and puts pressure on supply chains.

Design standardization, modular construction (using standardized, off-site prefabricated units), and digital tools such as Building Information Modeling (BIM) allow for risk reduction and faster project completion, while long-term partnerships and mature supply chains become essential for success, according to Soben/Accenture.

Data centers are no longer built as one-off projects but as repeatable products. Modularization and platform-based design mean using prefabricated components, digital models, and automated design rules to build faster and more safely. Because more components are produced in factories rather than directly on-site, they can be pre-tested so that they arrive ready for assembly and free of defects.

- In 2025, Uptime Intelligence identified 30 proposals for campuses over 1 GW (https://uptimeinstitute.com/resources/research-and-reports/five-data-center-predictions-for-2026) and nearly 100 projects of hundreds of MW globally, in addition to the 200 already existing.

- Thus, gigawatt-scale campuses are emerging, including in Europe, which require the same type of design, energy, and cooling systems that can be easily replicated from one site to another.

- Parametric MEP (Mechanical, Electrical, Plumbing) design allows for quick changes by adjusting values rather than redoing the entire project, enabling fast, standardized, and easily expandable construction.

Edge Data Centers Take Off

Edge data centers are growing rapidly, closer to cities and industrial areas, driven by the fast adoption of 5G technology and IoT devices. According to Research and Markets, cited by Soben, the market is expected to grow from USD 15.4 billion in 2024 to USD 39.8 billion in 2030 (https://sobencc.com/news/data-centre-trends-2026/).

The number of IoT connections is projected to increase from 19.9 billion in 2025 to 60.6 billion in 2034 (Statista), and real-time applications—telemedicine, autonomous vehicles, industrial automation—make modular edge data centers essential. Large operators are expanding their geographic presence to avoid energy grid congestion and to leverage local renewable energy sources. In 2026, location, deployment speed, and last-mile resilience therefore become key competitive advantages.

Power Grids Under Pressure: What Makes a Difference in 2026

Data center energy consumption is rising rapidly and could reach 1,050 TWh in 2026, driven by high demand for AI and GPUs, according to the International Energy Agency (IEA). In major data center markets and hubs in the U.S., Europe, and Asia, the average time to secure a connection to the public electricity grid exceeds four years. This situation puts pressure on grids, causing bottlenecks and delays, while operators are looking for hybrid and alternative solutions.

Immediate and hybrid solutions include on-site generation (https://www.cbre.com/insights/books/european-real-estate-market-outlook-2026/data-centres) using gas (+ renewable energy), gas turbines or piston engines, microgrids, and “behind-the-meter” systems that rely on gas or fuel cells as the primary source, with the grid as backup. At the same time, operators combine green energy (solar, wind) with battery storage to increase reliability and delivery speed, according to CBRE.

- Operators are even acquiring land near nuclear plants or repurposing former plants for local generation and storage, preparing for future technologies such as green hydrogen and small modular reactors (SMRs).

- Additionally, they are collaborating more closely with utility providers from the feasibility stage and exploring solutions that allow the data center to become an active grid participant through large-scale storage and demand response programs.

While gas remains a practical short-term solution in the U.S., in Europe, the focus is on renewable energy and “private wire transmission” solutions (dedicated lines connecting a specific energy producer directly to a consumer). In EMEA, this mix can reduce costs by up to 40% (https://www.jll.com/en-us/insights/market-outlook/global-data-centers) compared to reliance on the public grid, according to a JLL report.

Cooling Technologies of the Year?

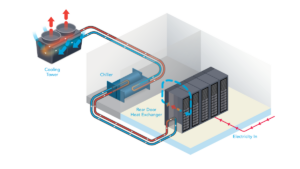

Liquid cooling is becoming the standard in AI data centers, with adoption rising from 14% in 2024 to 33% in 2025, and it is expected to reach 40% in 2026, according to Trendforce cited by Accenture. In the near future, data centers will use a combination of air-based and liquid-based cooling, while water-intensive evaporative methods will be phased out due to sustainability concerns and water scarcity.

Liquid cooling is becoming the standard in AI data centers, with adoption rising from 14% in 2024 to 33% in 2025, and it is expected to reach 40% in 2026, according to Trendforce cited by Accenture. In the near future, data centers will use a combination of air-based and liquid-based cooling, while water-intensive evaporative methods will be phased out due to sustainability concerns and water scarcity.

New liquid cooling technologies include cold plates, direct-to-chip, microfluidic, immersion, and two-phase cooling. These solutions promise higher energy efficiency and reduced water consumption, with energy savings for cooling of up to 50–60%. Liquid cooling is therefore expected to become mainstream, not just for specialized applications, as rack densities exceed the limits of traditional cooling technologies.

The focus in the coming years will be on standardization and interoperability, ensuring the integration of mixed cooling systems with power supply, monitoring, and operations so that efficiency and sustainability are maximized, regardless of the chosen cooling method.

AI Optimizes Design, Operation, and Performance of Data Centers

AI is transforming the data center industry, from design to operation and optimization. According to Gartner, investments in AI-optimized servers and infrastructure are expected to grow by 19% in 2026 (https://www.gartner.com/en/newsroom/press-releases/2025-10-22-gartner-forecasts-worldwide-it-spending-to-grow-9-point-8-percent-in-2026-exceeding-6-trillion-dollars-for-the-first-time), although supply constraints may limit short-term demand.

We will see how automated tools like BIM, machine learning algorithms, and AI-enabled equipment optimize airflow, energy consumption, and cooling. Additionally, digital twins and integrated AI platforms, which centralize data, allow real-time testing and adjustments, maximizing efficiency and uptime, according to global consulting firm Black & White Engineering.

At the same time, AI-based DCIM tools are becoming increasingly sophisticated, automating maintenance, predicting failures, and optimizing performance in real time, enhancing sustainability and operational efficiency. On the other hand, operators’ roles are evolving—they must interpret AI models, manage complex systems, and coordinate intelligent equipment equipped with IP interfaces.

Chips, Fiber Optics, and “New Electrification Topologies” (Uptime Intelligence)

On one hand, hyperscalers have already started developing their own AI chips to reduce dependence on Nvidia and increase operational efficiency. Google produces TPUs (Tensor Processing Units), Amazon is developing Tranium chips for internal use, and AMD is preparing to launch a new generation of GPUs in 2026.

In addition, technologies such as Hybrid Electrical/Optical Fabrics, Silicon Photonics, and Layer-1 Encryption enable data centers to handle large data volumes and unpredictable flows, near-instant connections (~10 µs), and secure sensitive data in transit.

Uptime Intelligence also anticipates that increasing data center density will drive the emergence of new electrical technologies, including medium-voltage (MV, 11 kV+) distribution closer to IT equipment, the reintroduction of direct current (DC), and products such as new MV UPS systems, 800V DC UPS, and solid-state transformers. These solutions will reduce costs and complexity while improving overall energy performance, even in small and medium-sized data centers.

Vacancy Rates Fall, Construction Costs Rise

In Europe, data center vacancy rates continue to decline: after falling below 10% at the end of 2024, they are expected to reach a historic low of 6.5% by the end of 2026 (https://www.cbre.com/insights/books/european-real-estate-market-outlook-2026/data-centres), according to CBRE. Beyond hyperscalers, more companies—including those offering GPU-as-a-Service (GPUaaS)—are now seeking to lease tens of megawatts of capacity across different regions in Europe. Even if over 750 MW are added this year—the equivalent of France’s entire colocation market in 2025—it will not be enough to meet demand, driving up prices and the need for innovative solutions.

- Construction costs have risen significantly in recent years. Between 2020 and 2025, the global average cost increased from USD 7.7 million to USD 10.7 million per MW, an annual growth of 7%, and for 2026, JLL estimates an additional 6% rise to USD 11.3 million per MW.

- The main factors in site selection remain speed of network connectivity, followed by community support, latency, and proximity to clients; however, for larger projects, cost variations become increasingly relevant.

- According to Soben/Accenture, while traditional cloud data centers cost between USD 8–10 million per MW, large-scale AI centers (GW+) can reach up to USD 17 million per MW. As a result, building larger data centers does not automatically reduce costs, as was previously assumed.

Supply Chain Risks: Rare Earth Elements (REEs)

As China restricts exports of rare earth elements, essential for data centers and connected infrastructure (e.g., fiber optic cables and permanent magnets), supply chain risks are intensifying. The IEA reports that in 2023–2024, China produced 60% of the world’s REEs (https://www.iea.org/reports/energy-technology-perspectives-2023/clean-energy-supply-chains-vulnerabilities) and 94% of all permanent magnets. Between 2023 and 2025, Beijing expanded restrictions to an increasing number of elements and products.

This situation creates a major vulnerability for Europe, where data center projects risk being impacted by shortages of critical materials. In response, mining and refining projects are currently being developed in the U.S., Australia, Brazil, Tanzania, and India, while REE recycling—currently less than 1% of consumption—is expected to become a solution in the coming years to avoid supply bottlenecks.

Sustainability and Circularity

Sustainability has become a central principle in data center design, influencing everything from prioritizing low-carbon materials and modular construction to water management, heat reuse, and integration of renewable energy.

Sustainability has become a central principle in data center design, influencing everything from prioritizing low-carbon materials and modular construction to water management, heat reuse, and integration of renewable energy.

In Europe, pressure from authorities, investors, and local communities is increasing: water-free or hybrid cooling technologies, recycled water use, low-carbon materials, BREEAM certifications (which assess overall building sustainability, including energy and water use), and transparent carbon reporting are all being required.

Beyond PUE, other metrics are becoming increasingly important, such as CUE (carbon footprint), WUE (water usage), and life cycle assessments (LCA) of buildings. Compliance with these metrics can facilitate permitting and attract investment.

Since 2024, the EU has required operators to report energy performance and utilize waste heat, and stricter rules are expected from 2026 under the new “EU Data Centre Energy Efficiency Package,” scheduled for the first half of the year.

- Attention to local communities is also increasing. Microsoft recently announced its five-point “Community-First AI Infrastructure” plan, committing to building data centers responsibly, with a positive impact on the communities where they are developed.

Skills Shortage and the Need to Develop New Competencies

Demand for skilled trades in data center construction is skyrocketing, especially for electricians, plumbers, carpenters, and MEP specialists. In mature markets, contractors and their supply chains are already overstretched, while emerging markets will require support and time to adapt. The growth of AI data centers and high-density facilities accelerates the need for engineers specialized in mechanics, power, cooling technologies, AI infrastructure, electrical network interconnection, and ESG (Environmental, Social, and Governance) experts.

Companies are addressing this shortage through training programs and partnerships with universities, such as the Google STAR Program, grants for electrician training, and upskilling courses offered by providers like Schneider Electric University. A new trend is that Generation Z is increasingly drawn to construction careers, attracted by high salaries and the opportunity to contribute to the digital economy. Those who succeed in attracting, training, and retaining these talents will have a clear advantage in delivering and operating modern data centers.

Looking ahead to 2026, in brief? Data centers will be built faster, modular, and more efficient, but challenges will also drive innovation and adaptation. For more information, check out the main reports behind this article:

- Soben/Accenture: Data Centre Trends 2026 report (https://sobencc.com/news/data-centre-trends-2026/)

- Uptime Intelligence / Uptime Institute: Five Data Center Predictions for 2026 (https://uptimeinstitute.com/resources/research-and-reports/five-data-center-predictions-for-2026)

- CBRE: European Real Estate Market Outlook 2026 (https://www.cbre.com/insights/books/european-real-estate-market-outlook-2026/data-centres)

- JLL: 2026 Global Data Center Outlook (https://www.jll.com/en-us/insights/market-outlook/global-data-centers)